Full vehicle history check for LL57HCS

Get a comprehensive vehicle report for LL57HCS that covers Outstanding Finance, Stolen and Exported and Plate/Colour Changes just for £9.99.

Frequently asked questions related to LL57HCS

You can check the history of this vehicle for free by clicking on the "Run a free basic check" button above. This will tell you all the running costs, tax rates, technical specs, MOT history and more!

| Vehicle Registration | LL57HCS |

| Road Tax Status | |

| Insurance Costs | Check now |

| Stolen Check | Over 300 cars are stolen every day |

| Finance Check Powered by Experian |

1 in 7 vehicles have outstanding finance. |

Recommended car buying guides

When the Best Time to Buy your Next Car?

Discover the optimal times to purchase your next car with Motorscan’s comprehensive guide. From navigating the impact of new registration plate releases to leveraging quieter periods, we unveil the strategic insights and advantageous conditions for both new and used car purchases so you can maximise your savings and drive away with the car of your dreams and a smile on your face!

Should You Buy Part Worn Tyres? Weighing the Pros and Cons

Looking at part worn tyres for your vehicle? These budget-friendly options might catch your eye as alternatives to brand-new ones, but it’s crucial to understand their specifics and adherence to legal and safety standards before diving in. In our comprehensive guide, Motorscan explores the world of second hand tyres, shedding light on their advantages and regulatory compliance and providing you with everything you need to know to make an informed choice!

Strategies for Minimising Car Depreciation

Car depreciation, an inevitable aspect of car ownership, impacts buyers and owners. Motorscan’s guide delves into this complex phenomenon, unravelling its mysteries and offering strategies to minimise its effects. From understanding depreciation rates to making smart buying choices, our comprehensive guide equips readers with all you need to know to protect vehicle investments!

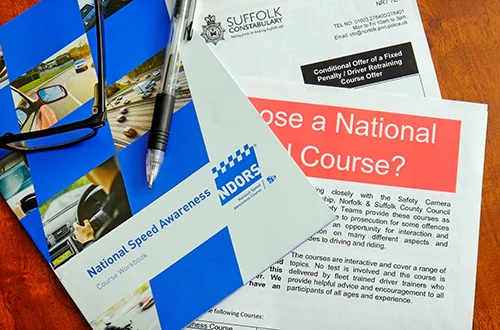

Speed Awareness Courses: What You Need to Know

Navigating the complexities of UK traffic regulations, Motorscan unveils all the crucial information on speed awareness courses. Our comprehensive guide explores eligibility criteria for drivers facing the possibility of attending these courses, shedding light on the entire process, from the benefits to the costs and providing valuable insights into what lies ahead!